27+ claiming mortgage interest

Comparisons Trusted by 55000000. If you take this credit you must reduce your mortgage interest deduction by the amount of the credit.

Can I Claim Loan Mortgage Interest As A Tax Reduction Moore

Instead you will claim the entire business use of the home portion of those expenses using lines 16 and 17.

. Web Yes you can split the mortgage interest and real estate tax deductions based on what you each paid. For 2019 about 13. A general rule of thumb is the person paying the expense gets to take the deduction.

Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and indirect curbs on them. Web First to claim the mortgage interest deduction taxpayers must itemize when filing federal tax returns rather than taking the standard deduction.

Web The amount you can claim as your mortgage interest tax deduction is 45000. To claim the mortgage interest deduction a taxpayer should use Schedule A which is part of the. There is no specific mortgage interest deduction unmarried couples can take.

Ad Get Instantly Matched With Your Ideal Mortgage Lender. Ad Our Trusted Reviews Help You Make A More Informed Refi Decision. You must file your federal income taxes using Form 1040 and itemize deductions on Schedule A.

You may also claim the deduction if you appear as an owner on the deed to. Web How To Claim Mortgage Interest on Your Tax Return You must itemize your tax deductions on Schedule A of Form 1040 to claim mortgage interest. Web Home acquisition debt.

The bigger tax benefit is with the person with the higher. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage. Web The IRS generally allows you to claim a mortgage interest deduction if youre listed as a borrower on the mortgage.

Figure the credit on Form 8396 Mortgage Interest Credit. Web You may be able to claim a mortgage interest credit if you were issued a mortgage credit certificate MCC by a state or local government. 16 2017 you can deduct interest on up to 1 million of mortgage.

Web How to claim the home mortgage interest deduction. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million. Web Taxpayers claiming the standard deduction.

13 1987 and before Dec. The co-owner is a spouse who is on the same return. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

Web Most homeowners can deduct all of their mortgage interest. If you took out a mortgage or refinance after Oct. You must have secured debt on a qualified home in which you have an ownership interest.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web There are different situations that affect how you deduct mortgage interest when co-owning a home. If you claim the standard deduction you will not include any mortgage interest mortgage insurance premiums or real estate taxes on lines 10 and 11.

How Much Interest Can You Save By Increasing Your Mortgage Payment. 10 Best Home Loan Lenders Compared Reviewed. How to Claim the Mortgage Interest Tax Deduction on Your Tax Return To claim the mortgage.

In your situation each of you can only claim the interest that you actually paid. Web There are two major hurdles you have to jump over to be eligible to claim the mortgage interest deduction. Lock Your Rate Today.

Save Real Money Today. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Mortgage Interest Deduction Rules Limits For 2023

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

Can I Claim Loan Mortgage Interest As A Tax Reduction Moore

27 Sample Quit Claim Deed Forms In Pdf Ms Word

Ex99x2 006 Jpg

Mortgage Comparison 30 Year At 4 75 Vs 15 Year At 3 75 My Money Blog

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

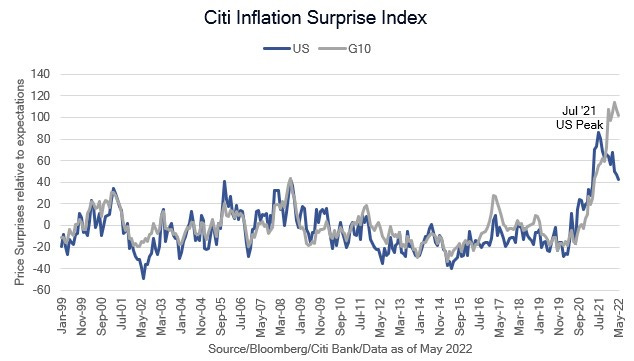

The Third Variable By Barry Knapp

What Is Mortgage

Robert Scaglione Mortgages

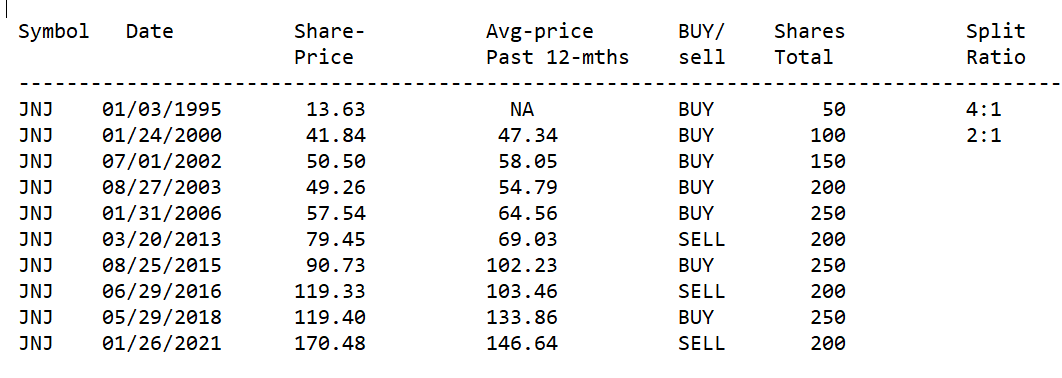

How To Build Wealth Buy Low And Sell High Consistently Seeking Alpha

5 Reasons Why A 20 Year Mortgage Is A Great Option Credit Sesame

Use These Charts To Quickly See How Much The Higher Mortgage Rates Will Cost You

30 Year Fixed Rate Mortgage Interest Rate Download Scientific Diagram

Loss Ratio Formula Calculator Example With Excel Template

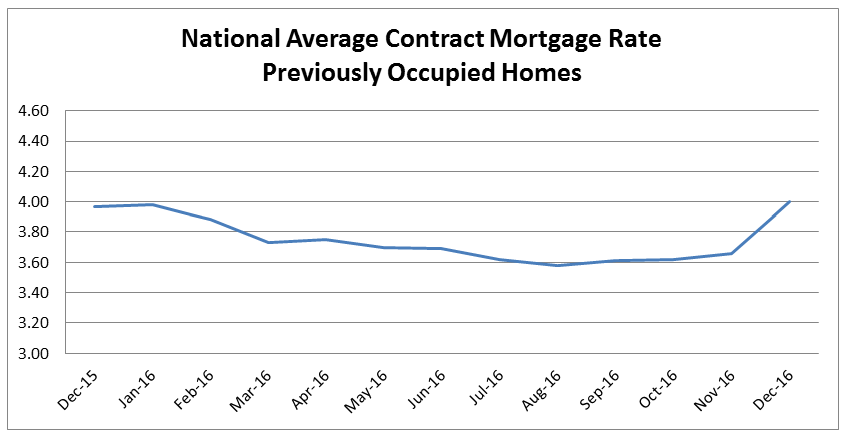

Public Affairs Detail Federal Housing Finance Agency

The Third Variable By Barry Knapp