Depreciation net book value formula

There are several types of depreciation. You can calculate net book value by finding the original cost of the.

How To Calculate Book Value 13 Steps With Pictures Wikihow

Computing the net book value depreciation amount amortization and reflecting the overall capital.

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-02-b230b73e49c3406ba7b944172f09a624.jpg)

. A businesss assets are listed on one side of the balance sheet. Download the Free Template. To find the book value of an asset the formula can be used.

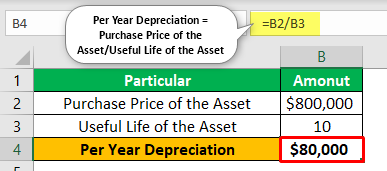

Considering the example of a computer that was purchased for 800. At the end of the second year company has depreciated this asset for 2 years so the. To do this analysts subtract all accumulated depreciation from the historical cost of the.

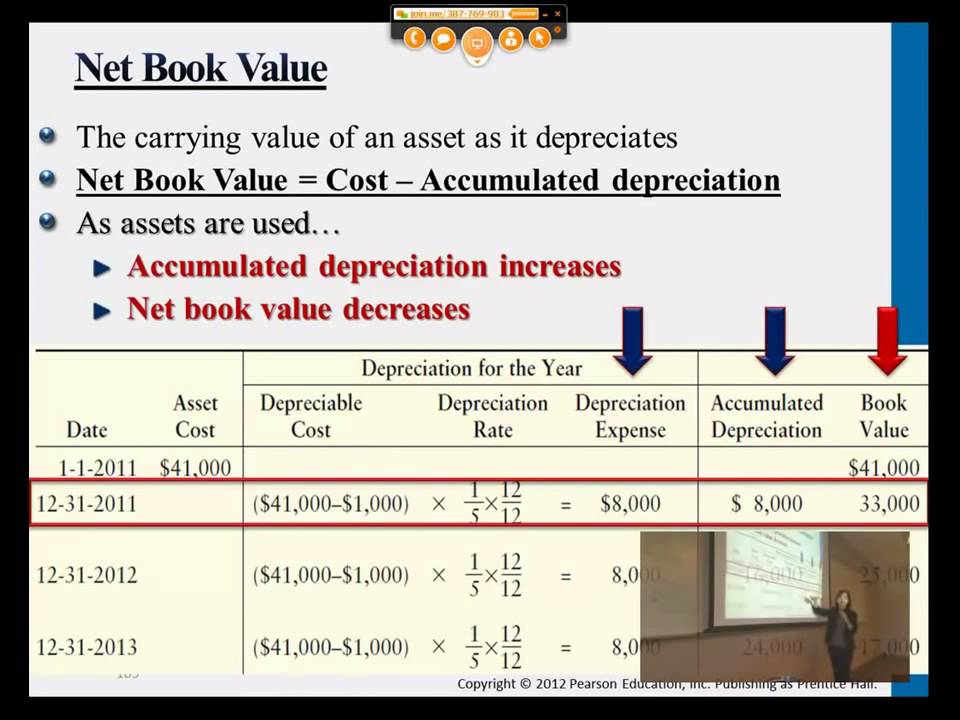

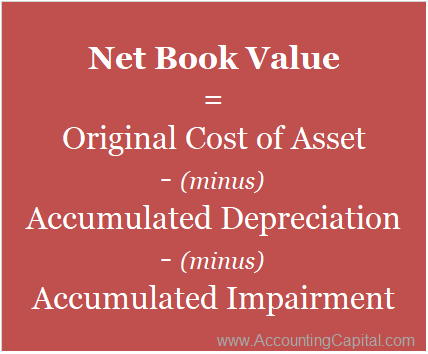

Net book value is the cost of an asset minus accumulated depreciation and accumulated impairment. Company ABC bought machinery worth 1000000 which is a fixed asset for the business. Accumulated Depreciation Formula Example 1.

You can create a diminishing value method to calculate tax depreciation using a reduced rate in the initial period year of acquisition. Net book value or NBV refers to the historical value of your business assets and how they get recorded. The net book value of an asset is the carrying value of the asset on the balance sheet.

This is the amount that was originally paid for the asset. Book Value on a Balance Sheet. For example ABC Trucking Company buys a semi truck for 100000 and depreciates it by 7000 per year for five years.

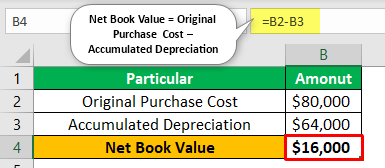

It is the balance recorded in its accounting records. Net Book Value Original Asset Cost Accumulated Depreciation. Depreciable value 50000-5000 45000.

Accumulated depreciation for 4 years 100000 10000204 72000 Then Net Book Value of Assets 100000 72000 USD 28000 In year fifth the accumulated depreciation. Accumulated depreciation here means total depreciation charged or accumulated by the company on its assets till the date of calculating the net book value of the. It has a useful life of 10 years and a.

Using the above net book value. How do you calculate the Net Book Value NBV. NBV can now be calculated by subtracting the accumulated depreciation from the cost of the refrigerator and comes to 80667.

Depreciation Amount for year one 1800. The closing value for year one is calculated by subtracting the. How Is Net Book Value Calculated.

Depreciation Expense 450005 9000 per years. 80667 1140 - 33333 Everything You Need To. Using the Book Value Equation.

Assets that have book value are those that are depreciated. They are listed in. It is calculated as the original cost.

Depreciation as per SLM 27000 25007 3500 Accumulated depreciation for 4 years 3500 4 14000 Net Book Value 27000 14000 13000. It is mostly through the depreciation of assets that we arrive at the net book value. Depreciation Amount for year one 10000 1000 x 20.

Depreciation Formula Calculate Depreciation Expense

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-02-b230b73e49c3406ba7b944172f09a624.jpg)

Why Is Accumulated Depreciation A Credit Balance

Reducing Balance Depreciation Calculation Double Entry Bookkeeping

Disposal Of Fixed Assets Journal Entries Double Entry Bookkeeping

Net Book Value Meaning Formula Calculate Net Book Value

Net Book Value Professor Victoria Chiu Youtube

Depreciation And Book Value Calculations Youtube

Net Book Value Meaning Formula Calculate Net Book Value

Net Book Value Meaning Formula Calculate Net Book Value

Net Book Value Meaning Example How To Calculate And More

.jpg)

Net Book Value Nbv Definition Meaning Investinganswers

Net Book Value Professor Victoria Chiu Youtube

Depreciation Of Fixed Assets Double Entry Bookkeeping

Salvage Value Formula Calculator Excel Template

How To Calculate Book Value 13 Steps With Pictures Wikihow

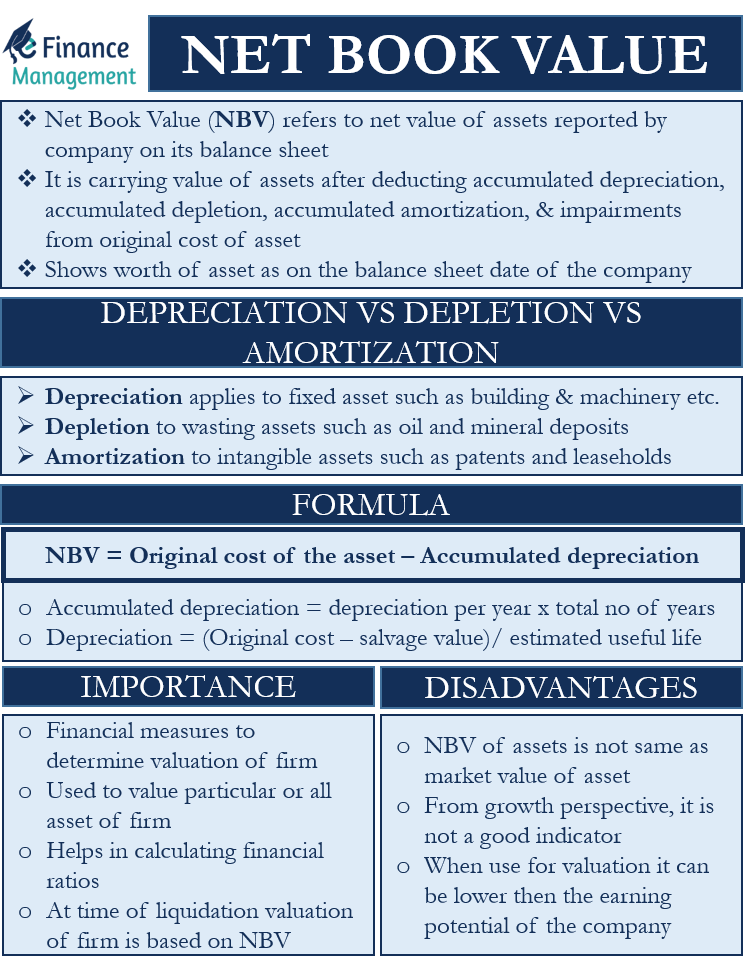

Net Book Value Meaning Calculation Example Pros And Cons Efm

How To Calculate Book Value 13 Steps With Pictures Wikihow